There’s no denying that the cost of living has gone up quite a bit over the last few decades. But even though our cost of living has increased, there are many ways we can cut our expenses and save money at the same time.

When you think about it, there’s a lot that goes into making sure you have enough to eat, keep warm, and live comfortably. So many expenses are based on necessity, not want.

But, if you’re like most people, you probably don’t save very much. Most of the money we spend on unnecessary things is because we don’t do it often enough. It’s the ultimate “should I or should I not?” question. If you analyze your spending habits and what you need vs. what you buy, there are some great ways to save money that won’t impact your lifestyle one bit.

Here are some great ideas for saving money on your home goods, services, and more:

1. Start with the basics

Before you start shopping for home goods and services, you’ll want to make sure you have the basics covered. This will allow you to save money without having to spend a lot of money on products you don’t need.

One great way to start saving money on your home goods and services is to get organized. If you don’t currently keep track of every purchase you make, you will likely end up spending a lot of money over the years on unnecessary things. Organize your bills and bills related to your purchases and you will be surprised how much money you save each month.

Getting started on the path to saving money on your home goods and services is to purchase a budget and stick to it. Create a spreadsheet or app that you can use to track your spending and make sure that you are staying within your budget. This will allow you to be more aware of what you are spending money on and allow you to make better choices. Knowing where your money is going will help you to save money in the long run.

2. Look for deals

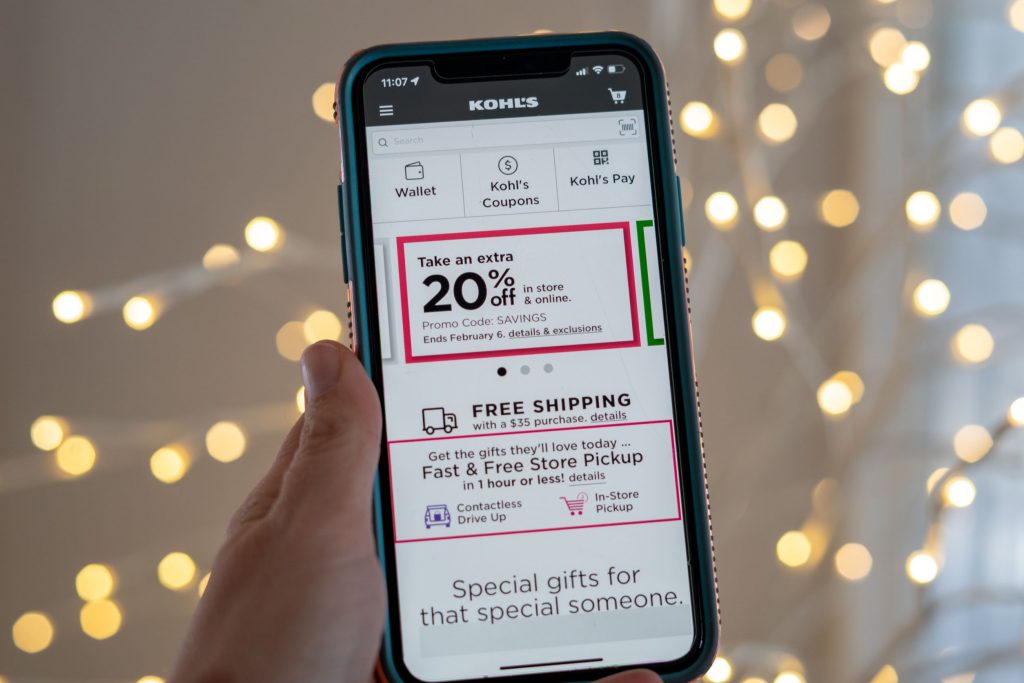

You might be surprised at how often deals are available for home goods and services. Just because you are paying the full retail price for an item, that doesn’t mean that it isn’t worth the discount. Many times you will find that there is a store deal for home furnishings and other items that you would normally purchase in bulk at a store.

You will also find Amazon deals on occasion. When you see a coupon or special that applies to the item you are looking for, try to use it before someone else does. This way, you will be able to get the lowest price possible and still get the item.

3. Set a budget and stick to it

Budgeting is a crucial part of any financial planning process. There are many ways to go about this, but the easiest way is to use a budget that you set for yourself each month. Use a strict monetary limit each time that you set a budget. This will help you to stay focused on what is important and will help you stay on track with your finances.

Your budget should be set higher than you think you will need. This way, if something unexpected comes up, you will still have money left over to pay for it. When you first start on a budget, it is hard to estimate how much money you will need. But as you progress through your financial life and begin to save some money, you will begin to get a better idea of how much money you need. Be sure to save at least 10% of your income each month.

4. Track your spending

If you’re like most people, you probably have a pretty clear idea of how much money you need to live on and what you spend that money on. But what happens when you try to plan a budget with add-ons like utilities, groceries, insurance, transportation, and other unnecessary expenses?

It’s usually very difficult to create a budget that works for everyone. People vary greatly in what they spend, where they live, and how they spend their money. The solution? Use a budget organizer to track your spending and stay on top of your spending. This can be a great way to stay on track and avoid impulse buys that turn into huge bills.

There are many different budget organizers available that can help you to track your spending and create a realistic budget every month. Some people like the software that comes with their computers because they can download it and use it on their computer or mobile device. Others prefer online budget planners because you can track your spending and create a budget that works for your lifestyle and personal situation.

You can also find software that will help you track your income and expenses and create a profit/loss for the month.

5. Look for coupons

When you’re trying to save money, it’s important to look for deals and coupons wherever possible. You may be able to get a free subscription to the newspaper when you split your daily newspaper with other government workers.

You can also access your local library and check out books for free every so often. You can also sign up for email deals and coupons from time to time. You can also look for coupons online through various sites.

In some cases, you can even find free food at certain locations like banks and grocery stores. When you’re looking for deals and coupons, be sure to keep in mind that many of them are free or cheap for a reason.

6. Look into used goods

When you are looking into used goods, be very careful. Some Used goods are actually in very good condition but have a cosmetic problem or two. When acquiring used goods, check to see if they have been tampered with. If you find that someone has altered the item, it is probably not worth the money.

Another thing to consider when looking into used goods is to check the condition of the item. Does it look as if it was used? If not, it probably isn’t worth much.

Another thing to keep in mind is to shop around for prices. Many times you will find good deals on sites like Craigslist and other online classifieds. Take your time when purchasing a used item. Take your time when acquiring a used good, and you will likely be glad you did.

7. Get organized with household items

You will never be able to save money on household supplies once you get started. Whether it is organizing your drawers or your closet, or cleaning out your organizing clutches, you will find that it is a huge time saver to have everything in its place.

This can especially be true when it comes to your finances. You will have a much better feel for what items you actually use and don’t use as often, which will help you to save money by shoehorning these items into your budget. You will also have a much easier time remembering to buy these items when they are on sale and the clearance rack at the supermarket.

To save money on home goods, it is important to keep your house and belongings as organized as possible. This will allow you to find what you need much faster, and will also prevent you from accidentally spending money on things that you don’t need.

8. Limit your purchases

When you make purchases that aren’t necessary, you’re essentially funding your in-case-of-emergency purchase. You could save yourself a lot of money in the long run if you limit your weekly grocery shopping to just one thing and your beverages too.

The first thing to understand about saving money is that you don’t have to make radical changes in your lifestyle.

9. Save money on furniture

When it comes to saving money on furniture, it is important to consider the long term. This means that you need to plan. It is recommended that you get a head start on the organization of your furniture and shop for new furniture at least 6 months in advance. This will give you plenty of time to get organized, plan out your bills, and get furniture ready to go.

It is not necessary to have the latest and greatest furniture. If you can fit it in the space that you have, great. But if not, you will want to get something that will work in the long run. Buying inexpensive chairs or love seats will work just fine for a few months while you save up for a more expensive piece.

10. Save money on home service companies

If you are trying to save money on home service companies, a good way to go is to shop around. There are plenty of great deals to be found online, and some of them can save you as much as 50%. The way that these companies are set up can often result in higher costs for services that should be included in the price of the service.

Check out reviews for the home service companies that you are considering. Make sure that you are getting a good value for your money. You will be doing yourself a favour by not spending more money in the long run by choosing the right service provider.

11. Consistency is key!

It’s important to keep your expenses as low as possible while still being able to enjoy your favourite foods, accumulate savings, and pay off your mortgage or car loan. The best way to do this is to make consistent changes in your life.

Do you know what you’re spending money on right now? Make a list and track it. Break down your spending by category and try to stay within a certain budget. If you’re constantly spending more than you make, you’re just going to end up spending more in total. Consistent spending is the key to success with savings!

Final Thoughts

Spend a little bit every day to save a lot of money over time. You will be glad you did. In this day and age, when it’s hard to find free money, any help you can get is a big help. So, what are you waiting for?